georgia ad valorem tax out of state

At that time a one-time Title Ad Valorem Tax TAVT must be paid based on the value of the vehicle. The accuracy completeness or adequacy of the information contained on this site or the information linked to on the state site.

Georgia Redeemable Tax Deed State House Deeds The Deed How To Find Out

PT-472NS Non-Resident Service Members Affidavit for Title Ad Valorem Tax on Motor Vehicles.

. ARTICLE 2 - PROPERTY TAX EXEMPTIONS AND DEFERRAL. The actual filing of documents is the veterans responsibility. I want to buy a car in a different state which has also has a sales tax on cars and bring it to Georgia and then get the registration and title there but do not want to double my tax payment.

However if you bought the car out of state for 45000 and registered it in Georgia then the state and local tax rates apply. ARTICLE 1 - GENERAL PROVISIONS. Income from retirement sources pensions and disability income is excluded up to the maximum amount allowed to be paid to an individual and his spouse under the federal Social.

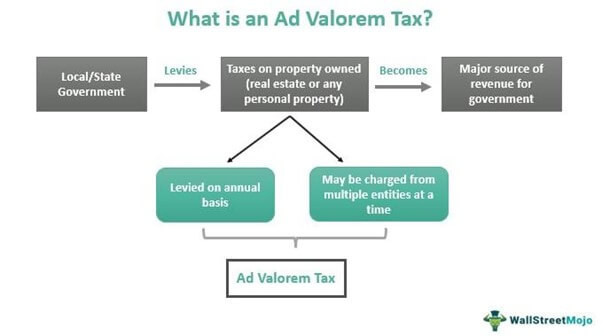

The links below are reports that show the ad valorem taxes that were levied by local counties schools and cities for the indicated tax year. Eservicesdrivesgagov If instead you intend to take delivery and keep the vehicle in Tennessee beyond the three-day-period you must pay the appropriate Tennessee sales tax. In Georgia ad valorem taxes are 66-percent.

The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those moving to. In the most recent legislative session the Georgia General Assembly passed Senate Bill 65 which made several changes to the title ad valorem tax TAVT code sections which apply to vehicles. As a result the annual vehicle ad valorem tax sometimes called the birthday tax is being changed to a state and local title ad valorem tax or TAVT.

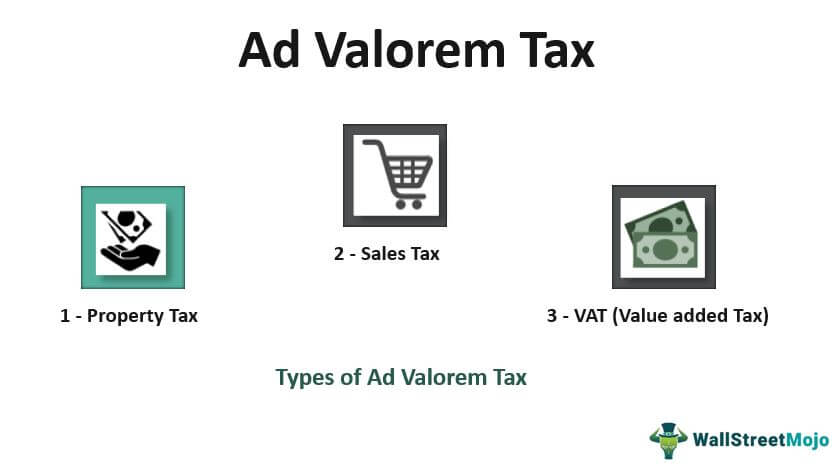

Individuals 65 years of age or over may claim a 4000 exemption from all state and county ad valorem taxes if the income of that person and his spouse does not exceed 10000 for the prior year. The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. Instead the purchased vehicles are subject to a one-time title ad valorem tax TAVT.

New residents must pay 50 percent of the ad valorem within. Call 1-800-GEORGIA to verify that a website is an official website of the State of Georgia. Ad Valorem Vehicle Taxes If you purchased your vehicle in Georgia before March 1 2013 you are subject to an annual tax.

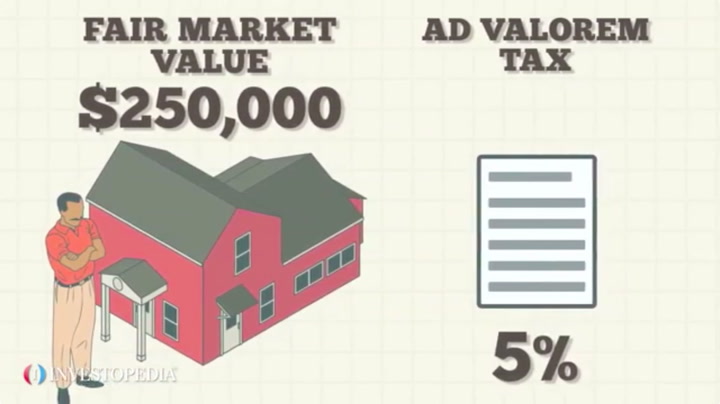

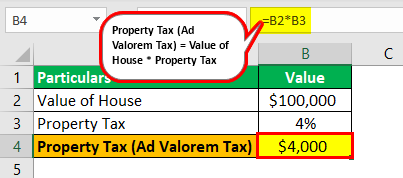

This value is calculated by averaging the current wholesale and retail values of the motor vehicle pursuant to OCGA. You can calculate the Title Ad Valorem Tax by finding the fair market value of the vehicle and multiplying it by 66. Accordingly the fair market value for a used motor vehicle for purposes of TAVT will generally be the same as the value that was used in the old annual ad valorem tax system.

In this example multiply 40000 by 066 to get 2640 which makes the total purchase price 47640. Use Ad Valorem Tax Calculator. Thereafter there is no annual ad.

Learn how Georgias state tax laws apply to you. After that you paid annual ad valorem tax at a lower rate. Beginning March 1 2013 state and local.

Some of the taxes levied may not be collected for various reasons assessment errors insolvency bankruptcy etc. Vehicles purchased on or after March 1 2013 and titled in Georgia are exempt from sales and use tax and the annual ad valorem tax ie. Please check official sources.

How does it work. You will now pay this one-time title fee when registering your car. 2010 Georgia Code TITLE 48 - REVENUE AND TAXATION CHAPTER 5 - AD VALOREM TAXATION OF PROPERTY.

This calculator can estimate the tax due when you buy a vehicle. Department of Revenue Department of Revenue. In the most recent legislative session the Georgia General Assembly passed Senate Bill 65 which made several changes to the title ad valorem tax TAVT code sections which apply to vehicles purchased or sold on or after January 1 2020.

The two changes that apply to most vehicle transactions are. If you are registering a new title for a car purchased out of state you will still be required to pay the ad valorem tax on the vehicle. PdfFiller allows users to edit sign fill and share all type of documents online.

The administration of tax exemptions is as interpreted by the tax commissioners of Georgias 159 counties. The legacy system was that you paid sales tax at the time of sale or in the case of out-of-state sales at the time of registration in the state of Georgia. For the answer to this question we consulted the Georgia Department of Revenue.

PT-472NS -Non-Resident Service Members Affidavit. For context Georgia charges a 7 Ad Valorem tax on obtaining a Georgia registration and title 7 of the fair market value. This tax is based on the value of the vehicle.

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. The property taxes levied means the taxes charged against taxable property in this state. To obtain verification letters of disability compensation from the Department of Veterans Affairs please call 1-800-827-1000.

Ad Register and Subscribe now to work with legal documents online. You can determine the TAVT amount at the following link. GDVS personnel will assist veterans in obtaining the necessary documentation for filing.

TAVT is a one-time fee that replaces the sales tax and the annual ad valorem tax often referred to as the birthday tax on motor vehicles. The TAVT rate will be lowered to 66 of the fair market value. The TAVT imposes a title tax at the time of purchase or initial registration in the state.

A reduction is made for the trade-in. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. Motor vehicles registered in Georgia.

State By State Guide To Taxes On Retirees States And Capitals Funny Retirement Gifts Retirement

Prudential Georgia Realty Joins Berkshire Hathaway Homeservices Real Estate Brokerage Network Berkshire Real Estate Things To Sell

Property Tax Map Tax Foundation

Ad Valorem Tax Meaning Types Examples With Calculation

Ad Valorem Tax Meaning Types Examples With Calculation

We Rated Every State For Taxes Based On State Income Taxes Local Sales Taxes Gas Taxes And More Find Out Where Your State Ranks Usa Map Map Gas Tax

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

How To Find A Georgia Employer Identification Number Property Tax Last Will And Testament Tax

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

When We Reach Retirement Age A Lot Of Us Plan To Move To That Dream State We Always Pictured Ourselves Growing Old Gas Tax Healthcare Costs Better Healthcare

7 Steps To Buying A Second Home Re Max Of Ga Remaxga Homebuyer Secondhome Vacationhome Buying First Home Home Buying Process Home Buying Tips

Ad Valorem Tax Meaning Types Examples With Calculation

Georgia Used Car Sales Tax Fees

Ad Valorem Tax Meaning Types Examples With Calculation

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax States